YRITTÄJÄ, tule mukaan omiesi pariin! Liity Yrittäjiin.

How much a maximum YEL income increase could affect you: see examples

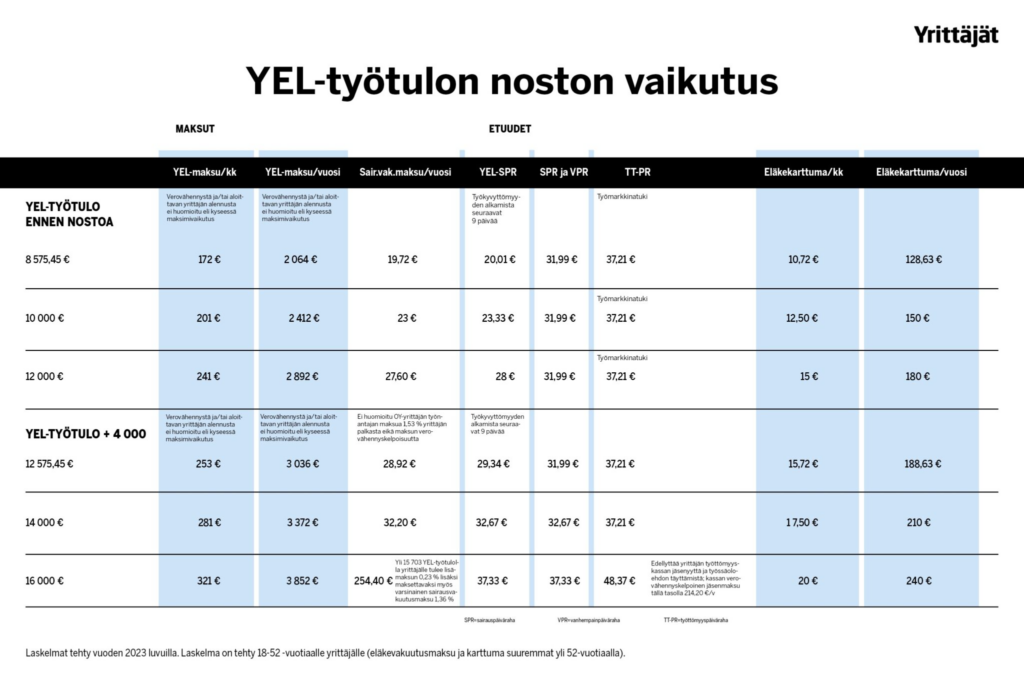

We calculated how much effect the maximum permitted increase in YEL income of €4,000 would have in three different cases.

The round of reviews of YEL incomes is currently under way. The pension provider Elo has said that a significant proportion of business owners has chosen to raise their YEL income by €4,000. In monthly YEL premiums, this means an increase of around €80.

A pension provider can raise a YEL income by a maximum of €4,000. This maximum increase is defined in the amended legislation which entered into force at the start of the year. The same maximum limit also applies on the second review round, which takes place three years after the first review round.

Yrittajat.fi calculated how a €4,000 increase in YEL income affects YEL premiums, social security and accrual of pension. The calculation was made for a business owner aged between 18 and 52.

Harri Hellstén, Labour Market Affairs Manager at Suomen Yrittäjät, says that making the calculations is not without its difficulties.

“The premiums not only affect benefits; they also affect the business owner’s and the company’s taxation, nor does the level of social welfare benefits change immediately when YEL income changes,” he says.

Effect of a YEL income increase

In the sample calculation, the effect of the YEL incomes is presented for three different YEL incomes before the increase in YEL income and after an increase in YEL income of €4,000.

The calculation shows that an increase of €4,000 increases monthly YEL premiums in all three sample cases by around €80.

An increased YEL income significantly improves the business owner’s situation if they fall ill. When a YEL income increases by €4,000 from the minimum level, the level of YEL daily sickness allowance rises by around €9.

However, increasing the YEL income does not lead to an increase of parental allowance in all cases. The effect is most obvious in the example where the YEL income increases from €12,000 to €16,000.

In all three sample cases, the accrued pension increased by around €60 a year.

Hellstén says that YEL is an insurance policy. Business owners do not usually aim to receive the social welfare benefits.

“This particularly applies to work disability benefits. For this reason, among other ways of securing your future, it should be compared mostly with other insurance products.”

The calculation shows that an increase of €4,000 increases monthly YEL premiums in all three sample cases by around €80.

Criticism for the YEL income calculator

Specialists at Suomen Yrittäjät have previously criticized the calculator used by the pension providers.

One tool which the pension providers use when calculating YEL incomes is the YEL Income Calculation Service, which the Finnish Centre for Pensions launched in September 2022.

Suomen Yrittäjät has criticized the calculator, as it completely omits the business owner’s own input of labour into the company, for example.

“The service is (even in the view of the Finnish Centre for Pensions itself) only an aid when evaluating the value of the labour input. Setting the YEL income is always the pension provider’s responsibility, and when the provider does so, it must consider all the factors it is aware of that affect its evaluation,” two Suomen Yrittäjät specialists recently blogged.

Read more about the YEL income reviews here.

Are you a Suomen Yrittäjät member yet? Read about member benefits and advantages

Pauli Reinikainen

pauli.reinikainen@yrittajat.fi